Research Tools

-

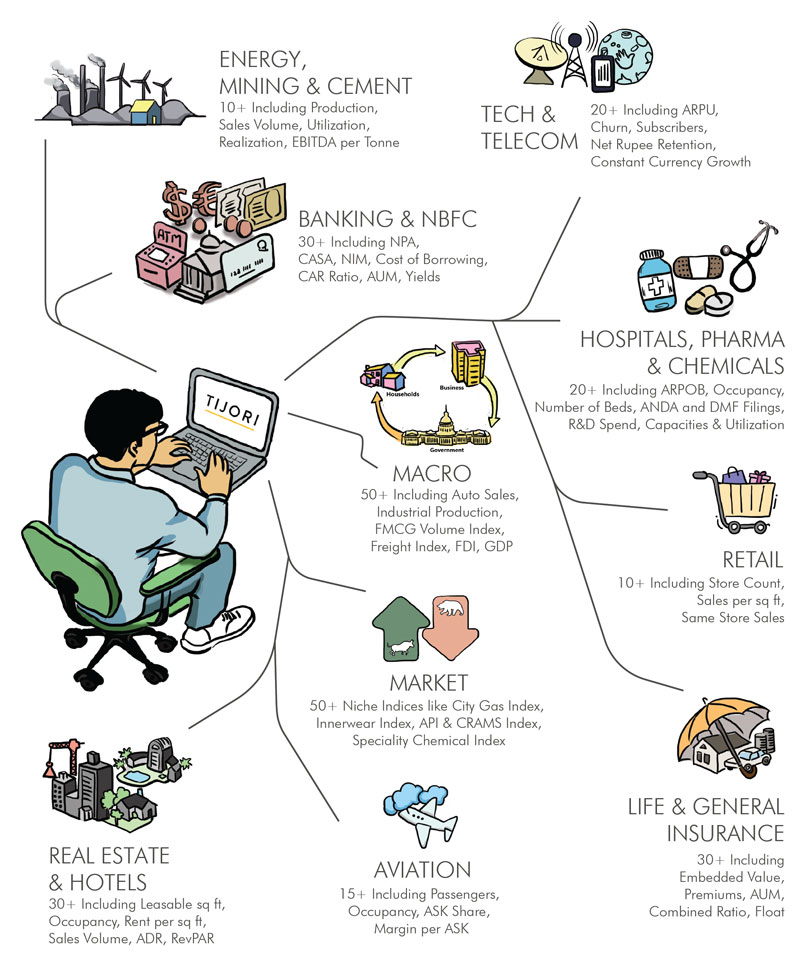

Operational MetricsAnalyze critical operational metrics of a company & compare it against their closest competitors

-

FilterDiscover new companies to invest in by filtering in simple natural language

-

SourceGo deeper in your research by clicking on source. This takes you straight to the base source of the data

-

Sector DataAnalyze the performance of over 20 sectors covered on Tijori

-

TJI IndexesMake your company’s benchmarking more relevant by comparing against niche sector specific indices.

-

Market MonitorMonitor performance across sectors

-

Raw MaterialsTrack price movements of key raw materials

-

Macro IndicatorsView macro-economic data sets which provides a high-level view of the economy

Tracking Tools

-

PortfolioKeep an eye on your investments and track of your exposure & risk

-

TimelineGet updates on exchange filings, marketshare and business changes, tweets and news about your companies in a personalised feed

-

WatchlistFollow your favourite stocks and make more informed trades by creating watchlists

-

AlertsAdd price/volume alerts and get notified when they are hit